Small Businesses: Careful Accounting Releases ERC Eligibility Guide to Assist Small Businesses

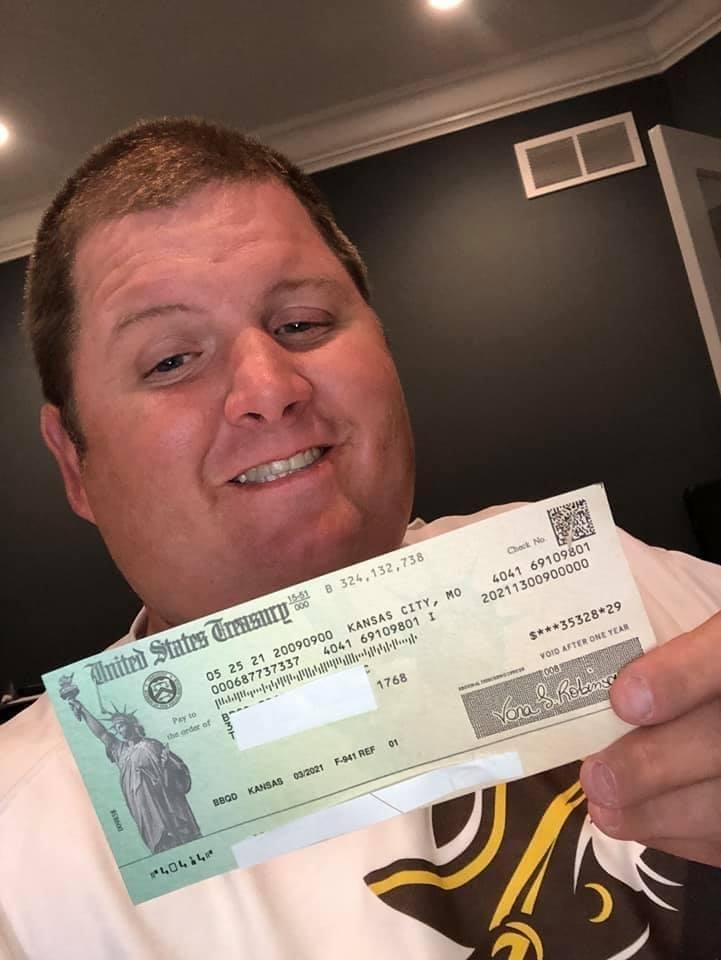

Small businesses impacted by the COVID-19 pandemic can receive much-needed support and financial relief through the Employee Retention Credit (ERC) program. Understanding the qualifications for the ERC is essential for businesses looking to take full advantage of this valuable program.

Miami, FL (Newsworthy.ai) Friday Jun 16, 2023 @ 12:30 PM EDT

Careful Accounting LLC, a trusted accounting firm, is urging small businesses to consider the benefits of the Employee Retention Credit (ERC) during these difficult times. This tax credit is a game-changer for businesses struggling due to the COVID-19 pandemic.

Understanding the qualifications for the ERC is essential for businesses looking to take full advantage of this valuable program.

The ERC is available to both for-profit and non-profit organizations, including corporations, partnerships, sole proprietors, and tax-exempt entities that meet certain qualifications. The credit applies during the period in question if a business faced partial or full suspension due to government orders. Businesses that suffered a significant decline in gross receipts also qualify, with a threshold of 50% in 2020 and 20% in 2021 and 2022.

According to a spokesperson for Careful Accounting LLC, "The ERC is a fantastic opportunity for small businesses to incentivize retention of employees and continued operations, ensuring their financial stability. Eligible businesses should be aware of the qualification criteria and take advantage of this program. Seeking the assistance of tax professionals can ensure they meet the eligibility criteria and take full advantage of the program."

In 2020, businesses were eligible if they faced partial or full suspension or if their gross receipts for any quarter were less than 50% of the gross receipts from the same quarter in 2019. For 2021, the qualification criteria remained the same, with the threshold for a significant decline in gross receipts lowered compared to 2020.

Small business owners are encouraged to consider the ERC to reduce the impact of the pandemic on their business operations. The program provides financial assistance for eligible businesses, allowing them to retain employees and boost their operations.

Careful Accounting LLC offers eligible businesses a consultation with tax professionals to ensure they meet the eligibility and qualification criteria and take full advantage of the program.

For more information on the Employee Retention Credit, visit the Careful Accounting LLC website.

Contact:

Name: Kate Whistler

Phone: (213) 789-5996

Email: [email protected]

Careful Accounting does not have any other recent news to report at this time.